Boost Your Competence with Bagley Risk Management

Boost Your Competence with Bagley Risk Management

Blog Article

Comprehending Livestock Risk Protection (LRP) Insurance Coverage: A Comprehensive Guide

Browsing the realm of animals danger defense (LRP) insurance policy can be a complex venture for lots of in the farming industry. From exactly how LRP insurance policy operates to the different insurance coverage options offered, there is much to reveal in this thorough guide that can possibly form the means animals manufacturers approach risk monitoring in their companies.

How LRP Insurance Coverage Works

Periodically, understanding the mechanics of Livestock Danger Security (LRP) insurance policy can be intricate, but damaging down exactly how it works can supply quality for herdsmans and farmers. LRP insurance policy is a threat monitoring device designed to shield animals manufacturers against unanticipated price declines. It's vital to keep in mind that LRP insurance is not a profits assurance; rather, it focuses exclusively on cost danger security.

Eligibility and Protection Options

When it comes to protection choices, LRP insurance coverage uses manufacturers the flexibility to choose the coverage degree, coverage period, and endorsements that best match their danger administration requirements. By comprehending the eligibility requirements and protection alternatives offered, animals manufacturers can make informed choices to handle danger effectively.

Benefits And Drawbacks of LRP Insurance Policy

When examining Animals Danger Protection (LRP) insurance, it is necessary for livestock producers to consider the disadvantages and advantages fundamental in this threat administration tool.

One of the primary advantages of LRP insurance policy is its ability to supply protection versus a decrease in animals costs. This can help secure manufacturers from economic losses resulting from market changes. In addition, LRP insurance supplies a degree of versatility, enabling producers to customize coverage levels and plan durations to fit their details needs. By securing an ensured cost for their animals, producers can better handle danger and plan for the future.

One restriction of LRP insurance is that it does not protect versus all types of threats, such as condition episodes or natural catastrophes. It is vital for manufacturers to meticulously examine their private threat exposure and economic situation to determine if LRP insurance policy is the ideal threat administration device for their operation.

Recognizing LRP Insurance Policy Premiums

Tips for Optimizing LRP Perks

Optimizing the benefits of Livestock Danger Protection (LRP) insurance policy calls for tactical planning and positive threat monitoring - Bagley Risk Management. To take advantage of your LRP coverage, consider the following suggestions:

Frequently Analyze Market Problems: Keep informed regarding market patterns and cost changes in the animals sector. By monitoring these factors, you can make educated choices concerning when to acquire LRP insurance coverage to protect against potential losses.

Establish Realistic Insurance Coverage Degrees: When choosing coverage degrees, consider your production prices, market value of animals, and possible risks - Bagley Risk Management. Setting realistic insurance coverage levels ensures that you are appropriately safeguarded without overpaying for unneeded insurance policy

Expand Your Coverage: Rather of depending solely on LRP insurance coverage, consider diversifying your risk management approaches. Incorporating LRP with other risk administration tools such as futures agreements or choices can supply detailed protection versus market uncertainties.

Evaluation and Change Coverage Frequently: As market problems change, occasionally examine your LRP insurance coverage to ensure it straightens with your present risk direct exposure. Readjusting coverage degrees and timing of purchases can aid enhance your risk security technique. By following these pointers, you can discover this info here optimize the benefits of LRP insurance and guard your livestock procedure versus unanticipated risks.

Verdict

Finally, animals risk security (LRP) insurance coverage is a beneficial tool for farmers to handle the financial threats connected with their livestock procedures. By comprehending how LRP works, qualification and protection choices, in addition to the advantages and disadvantages of this why not look here insurance policy, farmers can make educated decisions to protect their resources. By carefully taking into consideration LRP premiums and carrying out strategies to take full advantage of benefits, farmers can alleviate possible losses and ensure the sustainability of their procedures.

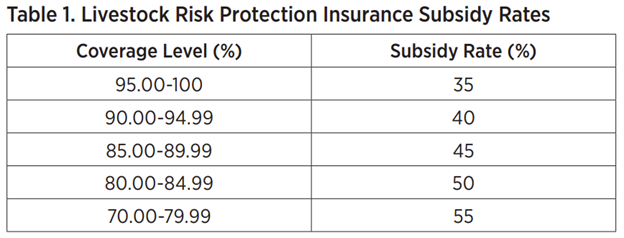

Animals producers interested in obtaining Livestock Threat Protection (LRP) insurance coverage can check out an array of qualification criteria and coverage options customized to their particular animals procedures.When it comes to coverage options, LRP insurance provides producers the versatility to select the protection level, coverage period, and endorsements that best suit their risk administration requirements.To understand the complexities of Animals Danger Protection (LRP) insurance completely, comprehending the elements influencing LRP insurance costs is critical. LRP insurance policy costs are identified by various components, consisting of the protection level chosen, the expected cost of livestock at the end of try this out the coverage duration, the type of livestock being insured, and the length of the insurance coverage period.Testimonial and Readjust Protection Regularly: As market problems alter, periodically evaluate your LRP coverage to ensure it aligns with your present danger exposure.

Report this page